Ombudsman for Debtors - Annual Report 2020

2020 was an unprecedented year for Icelanders and the world as a whole, due to a pandemic that began early in the year. 2020 was also quite eventful for the Office and various projects were carried out in a different way by the Office’s excellent staff.

Ásta S. Helgadóttir

Debtor´s ombudsman

2020 was an unprecedented year for Icelanders and the world as a whole because of the pandemic that began in the early part of the year. 2020 was also quite eventful for the Office and various projects were carried out in a different way by the Office’s excellent staff. The most important of these is the remote work of employees.

The Debtors’ Ombudsman has not been affected by the pandemic like other institutions in society and it is interesting to look over the past year and see how the operation has progressed.

The Directorate of Health changed the organisation of its operations in order to reduce the likelihood of transmission of coronavirus in the community. On March 12, visitors to the Kringlan 1 facility were closed and all services were recorded in telephone calls and e-mail communications. This arrangement proved particularly successful and there were no significant problems with services to applicants because of this.

2020 was the first full year in which a new application process was used for the reception of applications. In late 2019, a new arrangement was made regarding the application process, which has been successful. The number of applications in 2020 was quite comparable to the previous year, if the changed procedure is taken into account. During the year, a total of 905 applications were received due to financial problems. There were 1125 applications in the previous year.

The number of applications was not increased because of financial problems, but because of various governmental measures to help those who lost their jobs or suffered from income decrease. There were also various measures that came to light that have undoubtedly helped many people to stay in the country.

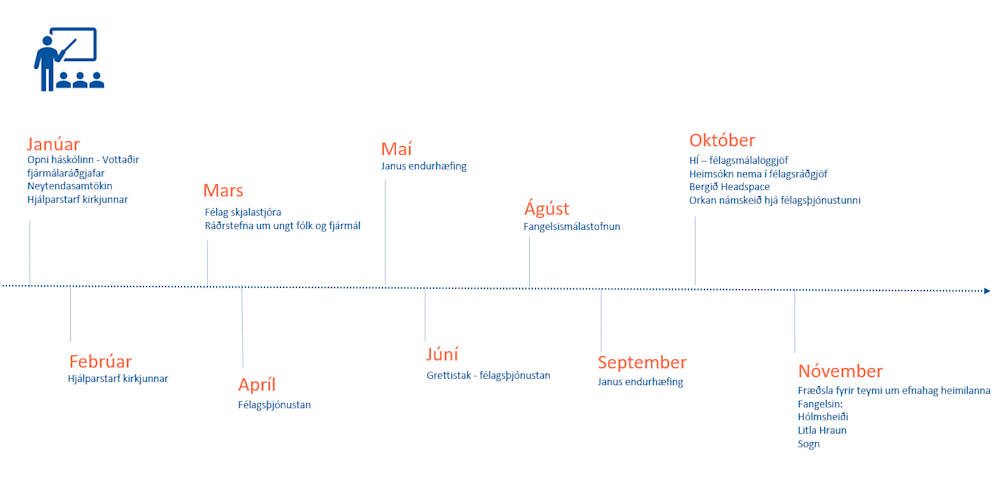

Education has been a major part of the Office’s activities in recent years. Due to Covid-19, there was somewhat less education in the usual way, but it can be said that the Office has used the year particularly well in education matters. A new project was started, which was named Leitin að peningunum.

At the end of October, the website Search for the Money was opened and at the same time, the same podcast was launched. The project was very successful and there have been many visits to the website and the podcasts have been very well received and they have been high on the list of the most popular podcasts in Iceland.

The Office's tasks are constantly evolving, as it is important that the services for individuals and families in difficulty with payments are in line with the developments that are taking place in society. I would like to conclude by offering my sincere thanks to the staff of the Office for their hard work during special times.

The office is primarily a service where individuals can receive free assistance from experts in resolving financial problems.

UMS services are free and electronic

Main projects:

Advice

Call inquiries and telephone consultation

Education about household finances

Type of maintenance criterion

The Office also implements the following resources:

Implementation

Granting financial assistance to

The objectives of the Debtors Ombudsman

Always provide the best service possible and the emphasis is on constantly looking for ways to improve it.

The Embassy maintains a strong telephone consultation where you can seek more information about the services available and receive answers to simple questions and advice on where to seek further answers or services.

In addition, you can also send inquiries to the office via the website, e.g. request a call or receive written answers to individual inquiries.

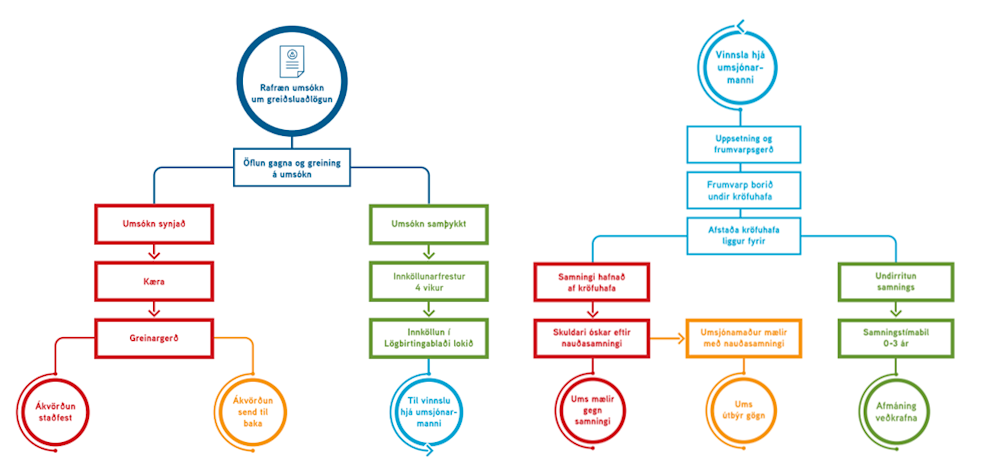

Application process

The office employs individuals with diverse education and extensive experience and the objective of the office is to add to the knowledge that has been generated.

The office seeks to offer its employees flexible working hours with the aim of making it easier for employees to balance work and private life without compromising the services provided by the office.

The Office has been fortunate over the years with good staff. The majority of employees have worked since the office was founded and even worked before before the office’s predecessor, which was the Financial Advisory Office for the Households (mean age takes into account this). The Office has therefore developed a great knowledge of what concerns the financial affairs of the households.

In 2020, 16 employees were in 15,3 positions. In addition, one employee was on maternity leave until October.

In addition, a law student worked for the office in part time for 6 months.

The Debtors’ Ombudsman grants employees to take care of their health and exercise. In 2020, health grants were paid out to 13 employees, of whom 10 employees received full grant and 3 partial grants. The total grant allocation was ISK 423,000.

One employee had an annual transport contract and received a transport grant of ISK 35,000.

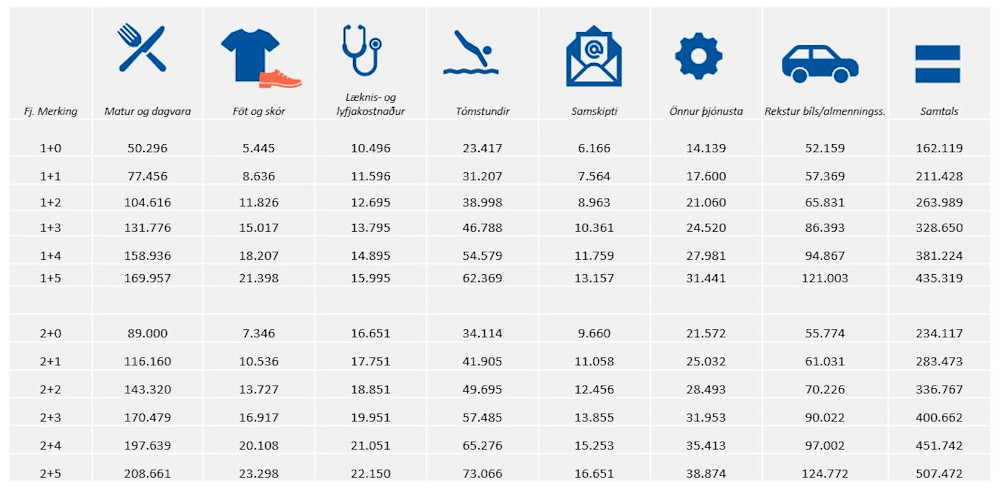

According to the Law on the Debtors Ombudsman, the Office is required to prepare maintenance criteria and regularly update them.

The Debtors' Ombudsman's ( Debtors' Ombudsman) standards are intended as a reference when solving debt problems through the Office's resources. The standards are intended for a shorter period than the standards of various other institutions, for example, typical standards of the Ministry of Welfare. The Office's standards take into account real expenditure of Icelandic households according to the expenditure survey of Icelandic households by Statistics Iceland.

Applicants must state in their application various costs of living, such as heat, electricity, childcare, property taxes and they are added to other costs to calculate the total cost of living for the family. The criteria thus take into account the circumstances of each applicant.

The role of the Debtors Ombudsman includes providing comprehensive advice and education on the finances of households.

The Office has promoted this project in various ways, such as through information on the website and on the office’s facebook page and through communication with the media about the problem of debtors and about the resources available.

The Office has put great emphasis on education and prevention in recent years and good cooperation has developed, e.g. with parties that service individuals who may need assistance due to financial problems. In 2019, 20 educational meetings were held. The Office has cooperated well with service centers in the capital area and offered education for social workers and other employees. The Office has also participated in various projects and offered education for participants and professionals.

New website

In March 2019, the final touches were made to the new website of the Office and it was launched on 25 March.

The website offers somewhat changed annual highlights, but in addition to accessible and useful information about the Office's resources, it contains various useful information about personal finances.

It is now possible to submit a request from the website and order a telephone call, and it is the hope of the office that this option will increase access for individuals to the service of the office.

The youngest group

On 25 March 2019, a morning meeting was held by the Debtors’ Ombudsman and the Association of Financial Institutions, the meeting was entitled: Loans for the young, young people and lending in the digital world.

The purpose of the meeting was to discuss the increase in the number of individuals between the ages of 18 and 29 who seek assistance from the Office because of financial problems.

The conference was very well attended, with over a hundred people attending to listen to presentations and panel discussions.

The Office’s annual report for 2018 analysed this group in a fairly detailed manner, stating that in 2018, this group comprised 27.5% of all applicants, and by the end of 2019, the same group comprised 35% of all applicants for payment adjustment.

Another characteristic of the group was that 77% of the individuals in this group had what the Office has defined as a quick loan. The composition of the group in 2019 is similar to 2018.

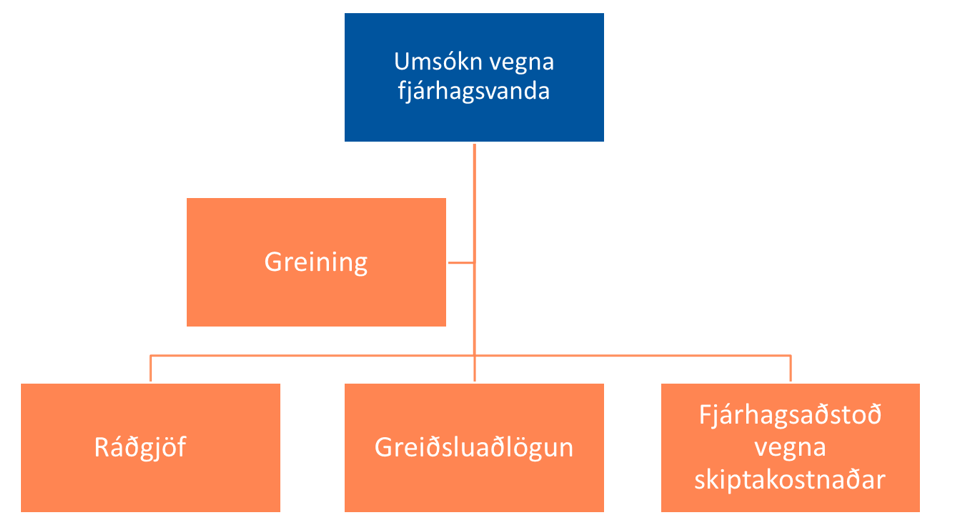

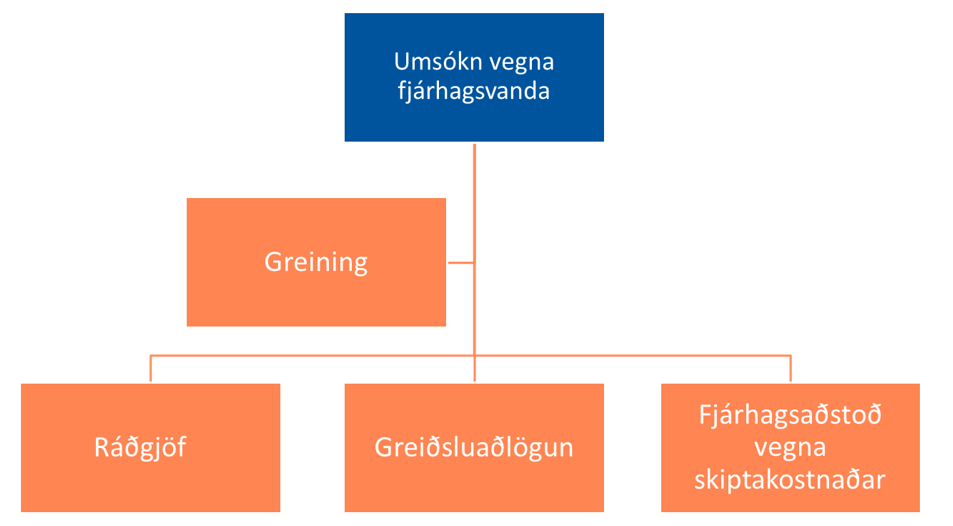

The first step in seeking formal assistance from the Debtors Ombudsman is to apply for assistance in financial difficulties

When an individual has decided to seek assistance from the Debtors Ombudsman because of financial problems, the first step is to submit an application.

The office's experts then analyse and evaluate in consultation with the applicant which remedies are best suited to resolve the problem of the person concerned.

This arrangement has been successful and has helped to reduce waiting times.

Total number of applications received by the Directorate in 2020

905 Applications for aid in the event of financial problems

Here you can see how the applications received in 2020 went after analysis.

533 Advice

323 Payment adjustment

65 Financial aid for the payment of transition costs

Applications for financial assistance in figures

Gender of applicant | Percentage % |

|---|---|

Karl | 54,3 % |

Woman | 45,7 % |

Age of applicants | Percentage % |

|---|---|

18 to 29 years | 27 % |

30 to 39 years old | 33 % |

40 to 49 years | 25 % |

50 to 59 years old | 11 % |

60 to 69 years old | 4 % |

Family size | Proportional distribution % |

|---|---|

1+0 | 71,4 % |

1+1 | 8,8 % |

1+2 | 7,5 % |

1+3 | 2,5 % |

1+4 | 0,9 % |

2+0 | 5,5 % |

2+1 | 0,9 % |

2+2 | 1,7 % |

2+3 | 0,6 % |

2+4 | |

2+5 | |

2+6 |

Residence form of applicants | Proportional distribution % |

|---|---|

Renting | 64 % |

Homeless | 6 % |

Own real estate | 8 % |

Other | 12 % |

In parent homes | 10% |

Position of applicants | Proportional distribution % |

|---|---|

At Work | 29 % |

In education | 2 % |

Disability or pension | 39 % |

Self-employed | 1 % |

Unemployed | 28 % |

Education of applicants | Proportional distribution % |

|---|---|

Elementary school exams | 57 % |

Industrial education | 14 % |

University degree | 15 % |

Student test | 14 % |

One of the roles of the Debtors Ombudsman is to provide free advice to individuals who are in serious difficulties with payments.

Advice is initiated after the application for assistance due to financial problems has been received and an analysis has been carried out in consultation with the applicant.

The advice includes the preparation of a credit difficulties assessment with the aim of gaining an overall view of the financial situation and seeking solutions.

With advice from the Debtors' Ombudsman, the aim is to resolve financial difficulties before the problem has become such that other remedies, such as a payment adjustment or bankruptcy, are needed. After processing the application, the applicant receives a summary of his/her financial situation, a credit difficulties assessment, and if possible, proposals for improvements. In some cases, the counselors assist applicants in seeking agreements with creditors, which may include, among other things, loan extensions, cancellation of late interest, loan freezing or loan modification.

If the above measures are not sufficient, applicants are advised to apply for personal adjustment or financial assistance to pay insurance for the costs of bankruptcy proceedings with the debtor's representative.

When the applications for counselling are examined, the gender distribution is quite even.

During the year, applications were processed

men 56%

females 44%

The largest number of applications in 2020 were individual applications (1+0) or 55%.

570 - Total number of applications for counselling

532 - Total number of completed applications Advice

Advice in numbers

In 2020, the following were:

32% with negative payment capacity

average assets 5,132,969 ISK

average debt 11.525.163 ISK

average payment capacity in settled cases 43,757 ISK

Information on applicants

Gender | Proportional distribution % |

|---|---|

Karl | 56 % |

Woman | 44 % |

Age | Proportional distribution % |

|---|---|

18 to 29 | 25 % |

30 to 39 | 33 % |

40 to 49 | 27 % |

50 to 59 | 11 % |

60 to 69 | 4 % |

70 years and older | 1 % |

Family size | Proportional distribution % |

|---|---|

1+0 | 54 % |

1+1 | 13 % |

1+2 | 7 % |

1+3 | 4 % |

1+4 | 1 % |

2+0 | 6 % |

2+1 | 5 % |

2+2 | 7 % |

2+3 | 2 % |

2+4 | 1 % |

Residence form | Proportional distribution % |

|---|---|

Right of residence | 0,6 % |

Homeless | 6,5 % |

Own real estate | 4 % |

In parent homes | 7,7 % |

Social rent | 11,5 % |

Renting | 59,8 % |

Other | 9,9 % |

Workplace | Proportional distribution % |

|---|---|

Unemployed | 26,9 % |

At Work | 23,5 % |

In education | 2,5 % |

Self-employed | 0,3 % |

Disability or pension | 46,1 % |

Homework | 0,6 % |

Educational status | Proportional distribution % |

|---|---|

University degree | 11,1 % |

Industrial education | 11,1 % |

Student test | 17,6 % |

Gunnskóli próf | 59,4 % |

Types of debt | Proportional distribution % |

|---|---|

Real estate loans | 13,6 % |

Car loans | 1,6 % |

Other bank loans | 31,3 % |

Withlag | 3,3 % |

Sequence payment - Credit card | 7,7 % |

Student loans | 15,9 % |

Taxes, checks and more | 9,7 % |

Other debts | 10 % |

Overdraft | 6,8 % |

The execution of the payment adjustment according to the Act on Personal Payment Adjustment No. 101/2010 is one of the principal roles of the debtor’s representative.

The objective of the Act on personal accounting is to enable individuals in severe credit difficulties to restructure their finances and to strike a balance between debt and ability to pay so that it is realistic for the debtor to meet his obligations for the foreseeable future.

Processing of payment adjustments is carried out entirely within the office where the supervisors handle the processing of payment adjustments from the beginning of the application to the end of the case.

The application system of the Directorate is electronic and applicants do not need to submit a written consent for data collection, but such consent is granted electronically. The application is entered through island.is, either with an ice key or electronic ID.

Processing of applications for individual payment adjustment can be completed in three ways, through approval, through refusal and through the applicant himself deciding to withdraw his application.

There may be more than one reason for refusing an application for a payment adjustment.

The most common reason for refusal in 2020 was the applicant’s unclear financial situation, but in 75% of applications, the applicant’s unclear financial situation was one of the reasons for refusal.

Appellate Decisions

Decisions of the Debtors Ombudsman on refusing the authorization to seek payment adjustment and on cancelling the authorization to seek payment adjustment can be appealed to the Welfare Appeals Board.

In 2020, there were 5 decisions on rejection of appeals, of which 2 decisions were confirmed, in one case an appeal was dropped. At the end of 2020, two appeals were still in the process of being processed by the Appeals Board.

Applications for payment adjustment in 2020

323 applications

282 deliveries

When the applications for payment adjustment are examined, it can be seen that women are in the majority of those who apply for individual payment adjustment.

57% women

43% male

The majority of applicants were individuals with the family label 1+0 or 70%.

29% approved

59% refused

13% withdrawn

Payment adjustment in figures

In 2020, there were:

44% with negative payment capacity

Average loan 1,660,407 ISK

Average debt ISK 7,746,862

Information on applicants

Gender | Percentage % |

|---|---|

Karl | 43 % |

Woman | 57 % |

Age | Percentage % |

|---|---|

18 to 29 years | 34,1 % |

30 to 39 years old | 31 % |

40 to 49 years | 21,1 % |

50 to 59 years old | 10,8 % |

60 to 69 years old | 3,1 % |

Family size | Percentage % |

|---|---|

1+0 | 55,7 % |

1+1 | 18,9 % |

1+2 | 7,7 % |

1+3 | 3,7 % |

1+4 | 3 % |

2+0 | 3,7 % |

2+1 | 4 % |

2+2 | 5,3 % |

2+3 | 1,9 % |

2+4 | 0,9 % |

2+5 | 0,3 % |

Residence form | Percentage % |

|---|---|

Other | 909 % |

Right of residence | 0,6 % |

Own real estate | 4% |

Social rent | 11,5 % |

Homeless | 6,5 % |

In parent homes | 7,7 % |

Renting | 59,8 % |

Workplace | Percentage % |

|---|---|

Unemployed | 26,9 % |

Homework | 0,6 % |

At Work | 23,5 % |

In education | 2,5 % |

Self-employed | 0,3 % |

Disability or pension | 46,1 % |

Educational status | Percentage % |

|---|---|

Elementary school exams | 59,4 % |

Industrial education | 11,1 % |

University degree | 11,1 % |

Student test | 17,6 % |

Types of debt | Percentage % |

|---|---|

Real estate loans | 13,6 % |

Car loans | 1,6 % |

Other bank loans | 31,3 % |

Co-op | 3,3 % |

Order payments - Credit card | 7,7 % |

Student loans | 15,9 % |

Taxes, VAT and more | 9,7 % |

Other debts | 10 % |

Overdraft | 6,8 % |

Payment Adjustment Process

Agreements for payment adjustment

After approving the application for a payment adjustment, a coordinator is appointed and the process of negotiating contracts begins.

When the creditor drafts a contract for the payment adjustment, the law on payment adjustment stipulates that the draft must ensure the maintenance of the debtor and his family and that it is realistic that he will be able to meet his obligations, restructure his finances and establish a balance between debt and ability to pay.

In 2020, 88 agreements were concluded for payment adjustment, while 59% of agreements provided for 100% repayment of all contractual obligations.

The period of payment adjustment in contracts in 2019 ranged from no period to 36 months. The most common result was 24 months or 33% of contracts.

Payment adjustments may provide for the total retention of individual claims, their proportional reduction, their maturity, their terms, their payment with a share of the instalment amount paid in certain intervals over a certain period, the change of the form of payment of claims or all of the above at once.

Various factors are considered, e.g. debt amount, family status and age, and it is the role of the depositary in consultation with the debtor to assess how a contract is best suited to meet the conditions of the Act discussed above.

In 2020, 88 agreements were concluded. Gender ratio:

69 % women

31 % male

Most applications were processed as individual contracts (1+0) or 62%

Contracts for payment adjustment in figures

In 2020, there were:

64% with negative payment capacity

Average loan ISK 537,609

Average debt 5.555.042 ISK

Year | Total number of contracts |

|---|---|

2018 | 77 |

2019 | 88 |

Year | Average duration of contracts |

|---|---|

2018 | 14,9 |

2019 | 14,03 |

Year | Among the capacity for payment |

|---|---|

2018 | -13,183 |

2019 | -19,271 |

Year | Average disposable income |

|---|---|

2018 | 321,546 |

2019 | 316364 |

Rate of retention in contracts | Number |

|---|---|

0,0 | 34 |

80% | 1 |

90% | 1 |

100% | 52 |

Types of debt | Percentage |

|---|---|

Real estate loans | 11,6 % |

Car loans | 2,2 % |

Other bank loans | 31,6 % |

Withlag | 0,6 % |

Order payments and credit cards | 7,4 % |

Student loans | 21,5 % |

Taxes, VAT and more | 5,6 % |

Other | 9,2 % |

Overdraft | 10,2 % |

Amendment to the Agreement

When the depositary proposes a contract between the debtor and the creditor, the objective is always that the contract is realistic and is suitable for solving the debtor's payment and debt problems. However, it is never possible to exclude that something occurs during the contract period that prevents the debtor from fulfilling the contract that was made.

If unforeseen circumstances occur during the contract period that weaken the ability of the debtor to comply with his payment adjustment agreement, the debtor may request the creditor to change the agreement.

Since 2013 the process has been implemented whereby the Debtors Ombudsman acts as a mediator for the claimant on behalf of the debtor, although the law allows the debtor to perform this role himself.

Experience has shown that it is a great burden for debtors to perform this role themselves and the Office has been better able to reach a settlement on the amended contract in line with the ability of debtors.

The Act on Financial Assistance to Pay the Guarantee for the Settlement of Bankruptcy Expenses No. 9/2014 came into force on 1 February 2014.

The remedy consists in the applicant requesting to receive a guarantee for the cost of liquidation for bankruptcy proceedings, subject to certain conditions.

The aim is to enable individuals who have experienced significant payment problems and have unsuccessfully sought other payment solutions to claim for the change of their livestock.

The main criteria are that the applicant has significant payment problems, that the applicant cannot meet the insurance for the costs of bankruptcy and that other payment problems are not sufficient to solve the applicant’s payment problems. Similar criteria are also contained in the Act on Individuals’ Payment Adjustment No. 101/2010, which the applicant must meet in order to be authorized to seek payment adjustment.

There may be more than one reason for the rejection of an application for financial aid to cover the cost of the exchange.

In 2020, the most common reason for rejection was that the applicant did not meet the requirement of Article 3(1)(b) of the Bankruptcy Code, that the applicant must not be able to satisfy the requirement of a guarantee for the costs of bankruptcy, taking into account the assets and liabilities of the applicant.

In 2020, 32 individuals who had been approved for financial assistance to pay collateral for the costs of bankruptcy proceedings requested their estate to be taken to bankruptcy.

At the beginning of 2020, 67 individuals had received approval for financial assistance but had not requested their farms to be subject to bankruptcy.

Applications for financial aid to cover the cost of switching in 2020 in figures

The applicants were:

72% male

28% women

The largest number of applications were individual applications (1+0) or 71%

65 - Total number of applications for financial aid for exchange costs

55% of applications accepted

38 % of applications rejected

7 % of applications rejected

Other information:

50% with negative payment capacity

average assets 208.620 ISK

average debt 13.018.028 ISK

Statistical information on exchange costs

Age of applicants | Percentage % |

|---|---|

18 to 29 years | 21,5 % |

30 to 39 years old | 38,5 % |

40 to 49 years | 18,5 % |

50 to 59 years old | 15,4 % |

60 to 69 years old | 6,2 % |

Education | Percentage % |

|---|---|

Elementary school exams | 56,9 % |

University degree | 24,6 % |

Industrial education | 6,2 % |

Student test | 12,3 % |

Residence form | Percentage % |

|---|---|

Renting | 41,5 % |

Other | 26,2 % |

Social rent | 10,8 % |

Homeless | 9,2 % |

In parent homes | 12,3 % |

Workplace | Percentage % |

|---|---|

At Work | 20 % |

Disability or pension | 36,9 % |

Unemployed | 38,5 % |

In education | 3,1 % |

Self-employed | 1,5 % |

Family size | Percentage % |

|---|---|

1+0 | 83 % |

1+1 | 6 % |

1+2 | 8 % |

1+3 | 3 % |

Types of debt | Percentage % |

|---|---|

Real estate loans | 1,6 % |

Car loans | 1,6 % |

Other bank loans | 28,1 % |

Co-op | 19,3 % |

Order payments - Credit card | 5 % |

Student loans | 12,7 % |

Taxes, VAT and more | 14,4 % |

Other debts | 10,5 % |

Overdraft | 7 % |